Multiple Choice

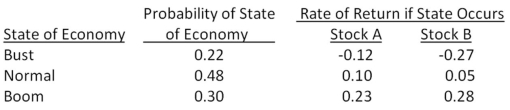

Suppose you observe the following situation:  Assume the capital asset pricing model holds and stock A's beta is greater than stock B's beta by 0.21.What is the expected market risk premium?

Assume the capital asset pricing model holds and stock A's beta is greater than stock B's beta by 0.21.What is the expected market risk premium?

A) 8.8 percent

B) 9.5 percent

C) 12.6 percent

D) 17.9 percent

E) 20.0 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q34: The expected return on a portfolio:<br>I. can

Q50: The expected return on a portfolio considers

Q52: The expected return on JK stock is

Q53: Which one of the following will be

Q54: Jerilu Markets has a beta of 1.09.The

Q54: The standard deviation of a portfolio:<br>A) is

Q56: Which one of the following stocks is

Q57: Standard deviation measures which type of risk?<br>A)total<br>B)nondiversifiable<br>C)unsystematic<br>D)systematic<br>E)economic

Q58: The systematic risk of the market is

Q60: Which one of the following is the