Multiple Choice

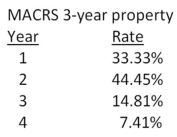

Peterborough Trucking just purchased some fixed assets that are classified as 3-year property for MACRS.The assets cost $10,600.What is the amount of the depreciation expense in year 3?

A) $537.52

B) $1,347.17

C) $1,569.86

D) $1,929.11

E) $2,177.56

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The bid price always assumes which one

Q70: Keyser Petroleum just purchased some equipment at

Q71: Hollister & Hollister is considering a new

Q72: Phone Home,Inc.is considering a new 4-year expansion

Q73: Bernie's Beverages purchased some fixed assets classified

Q74: Northern Railway is considering a project which

Q77: Kelley's Baskets makes handmade baskets for distribution

Q78: The top-down approach to computing the operating

Q79: Which one of the following is an

Q80: The bid price is:<br>A)an aftertax price.<br>B)the aftertax