Multiple Choice

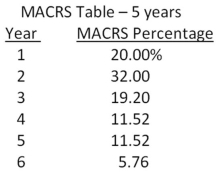

Chapman Machine Shop is considering a 4-year project to improve its production efficiency.Buying a new machine press for $576,000 is estimated to result in $192,000 in annual pretax cost savings.The press falls in the MACRS 5-year class,and it will have a salvage value at the end of the project of $84,000.The press also requires an initial investment in spare parts inventory of $24,000,along with an additional $3,600 in inventory for each succeeding year of the project.The inventory will return to its original level when the project ends.The shop's tax rate is 35 percent and its discount rate is 11 percent.Should the firm buy and install the machine press? Why or why not?

A) no; The net present value is -$7,489.

B) no; The net present value is -$667.

C) yes; The net present value is $211.

D) yes; The net present value is $4,319.

E) yes; The net present value is $8,364.

Correct Answer:

Verified

Correct Answer:

Verified

Q89: The Pancake House has sales of $1,642,000,depreciation

Q90: Bruno's Lunch Counter is expanding and expects

Q91: Gateway Communications is considering a project with

Q92: Changes in the net working capital requirements:<br>A)can

Q93: Colors and More is considering replacing the

Q95: You are working on a bid to

Q96: Webster & Moore paid $148,000,in cash,for a

Q97: What is the formula for the tax-shield

Q98: Your firm is contemplating the purchase of

Q99: Hollister & Hollister is considering a new