Multiple Choice

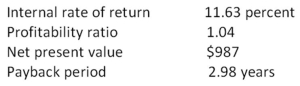

You are considering a project with conventional cash flows and the following characteristics:  Which of the following statements is correct given this information?

Which of the following statements is correct given this information?

I.The discount rate used in computing the net present value was less than 11.63 percent.

II.The discounted payback period must be more than 2.98 years.

III.The discount rate used in the computation of the profitability ratio was 11.63 percent.

IV.This project should be accepted as the internal rate of return exceeds the required return.

A) I and II only

B) III and IV only

C) I, II, and IV only

D) II, III, and IV only

E) I, II, III, and IV

Correct Answer:

Verified

Correct Answer:

Verified

Q41: You would like to invest in the

Q42: You are viewing a graph that plots

Q43: A project has a discounted payback period

Q44: Based on the profitability index rule,should a

Q45: The final decision on which one of

Q47: What is the net present value of

Q48: Which two methods of project analysis are

Q49: Which of the following are definite indicators

Q50: How does the net present value (NPV)decision

Q51: Which one of the following statements related