Multiple Choice

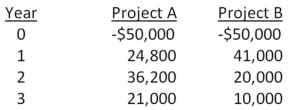

You are considering the following two mutually exclusive projects.The required rate of return is 14.6 percent for project A and 13.8 percent for project B.Which project should you accept and why?

A) project A; because it has the higher required rate of return

B) project A; because its NPV is about $4,900 more than the NPV of project B

C) project B; because it has the largest total cash inflow

D) project B; because it has the largest cash inflow in year one

E) project B; because it has the lower required return

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Western Beef Exporters is considering a project

Q67: Which of the following are considered weaknesses

Q68: You are considering a project with an

Q69: A project has an initial cost of

Q70: Which one of the following statements is

Q71: The Square Box is considering two projects,both

Q73: The profitability index is most closely related

Q74: A project has an initial cost of

Q76: A project has average net income of

Q77: A firm evaluates all of its projects