Multiple Choice

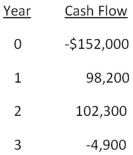

You are considering an investment with the following cash flows.If the required rate of return for this investment is 15.5 percent,should you accept the investment based solely on the internal rate of return rule? Why or why not?

A) Yes; The IRR exceeds the required return.

B) Yes; The IRR is less than the required return.

C) No; The IRR is less than the required return.

D) No; The IRR exceeds the required return.

E) You cannot apply the IRR rule in this case.

Correct Answer:

Verified

Correct Answer:

Verified

Q90: Which one of the following statements related

Q93: Tedder Mining has analyzed a proposed expansion

Q94: Sheakley Industries is considering expanding its current

Q95: The Chandler Group wants to set up

Q96: You are considering two independent projects both

Q97: Douglass Interiors is considering two mutually exclusive

Q99: Which of the following statements related to

Q100: You are considering the following two mutually

Q101: You are analyzing a project and have

Q103: You are considering the following two mutually