Multiple Choice

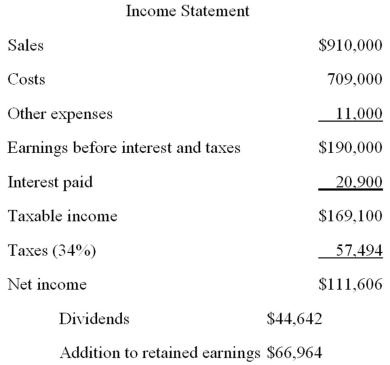

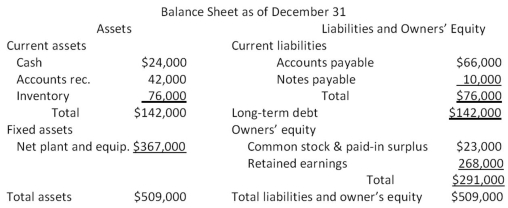

The most recent financial statements for Moose Tours,Inc.follow.Sales for 2009 are projected to grow by 16 percent.Interest expense will remain constant; the tax rate and dividend payout rate will also remain constant.Costs,other expenses,current assets,and accounts payable increase spontaneously will sales.If the firm is operating at full capacity and no new debt or equity is issued,how much external financing is needed to support the 16 percent growth rate in sales?

A) $-10,246

B) -$8,122

C) -$6,708

D) $2,407

E) $3,309

Correct Answer:

Verified

Correct Answer:

Verified

Q70: Blasco Industries is currently at full-capacity sales.Which

Q71: Seaweed Mfg.,Inc.is currently operating at only 86

Q72: You are developing a financial plan for

Q73: Which of the following are needed to

Q74: A firm wishes to maintain a growth

Q76: The Dog House has net income of

Q77: Which one of the following statements is

Q78: Consider the income statement for Heir Jordan

Q79: Financial planning accomplishes which of the following

Q80: Which one of the following will increase