Multiple Choice

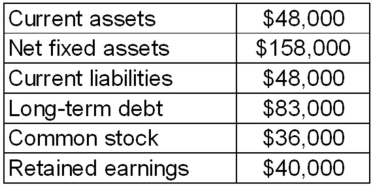

A firm has the following account balances for this year.Sales for the year are $500,000.Projected sales for next year are $545,000.The percentage of sales approach is used for pro forma purposes.All balance sheet accounts,except long-term debt and common stock,change according to that approach.The firm plans to decrease the long-term debt balance by $5,000 next year.Retained earnings is expected to increase by $3,500 next year.What is the projected external financing need?

A) $10,520

B) $14,720

C) $18,520

D) $20,720

E) $25,620

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Wholesale Grocer's has total assets of $580,000

Q45: Which one of the following is NOT

Q52: Glassmakers,Inc.purchased $137,600 of new equipment this year

Q53: Whole Wheat Farms,Inc.has a net income of

Q57: A firm has $4,200 of cash, equipment

Q74: What value does the Statement of Cash

Q75: HNW Manufacturing,Inc.has 255,000 shares of stock outstanding.The

Q77: The management of the Uptown Bikes recently

Q79: Explain the role the external financing need

Q102: Which one of the following statements related