Multiple Choice

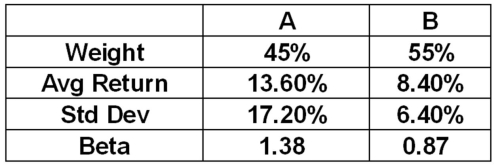

What is the Treynor ratio of a portfolio comprised of 45 percent portfolio A and 55 percent portfolio B?  The risk-free rate is 3.12 percent and the market risk premium is 8.5 percent.

The risk-free rate is 3.12 percent and the market risk premium is 8.5 percent.

A) .041

B) .058

C) .069

D) .114

E) .136

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q22: You have computed the expected return using

Q38: The risk premium of a portfolio divided

Q52: A Sharpe-optimal portfolio provides which one of

Q82: A portfolio has a beta of 1.26,a

Q83: Which one of the following assesses the

Q84: A portfolio has a beta of 1.16,a

Q85: A portfolio has a Sharpe ratio of

Q88: High Mountain Homes has an expected annual

Q88: The Miller Fund's correlation with the market

Q91: A portfolio has an average return of