Multiple Choice

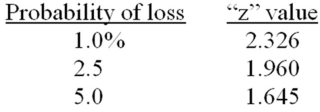

You have a portfolio which has an average return of 10.3 percent.In any given year,you have a 2.5 percent probability of earning either a zero or a negative annual return.What is the approximate standard deviation of your portfolio?

A) 5.26 percent

B) 6.43 percent

C) 6.94 percent

D) 7.60 percent

E) 8.14 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Which one of the following measures risk

Q31: The Jensen-Treynor alpha is equal to:<br>A)the Treynor

Q44: You want to create the best portfolio

Q64: Which one of the following statements is

Q68: A portfolio has a Treynor ratio of

Q73: Your portfolio has a standard deviation of

Q75: A portfolio has a variance of .027556,a

Q84: Which one of the following assesses risk

Q89: A portfolio has an expected annual return

Q101: Which one of the following measures a