Multiple Choice

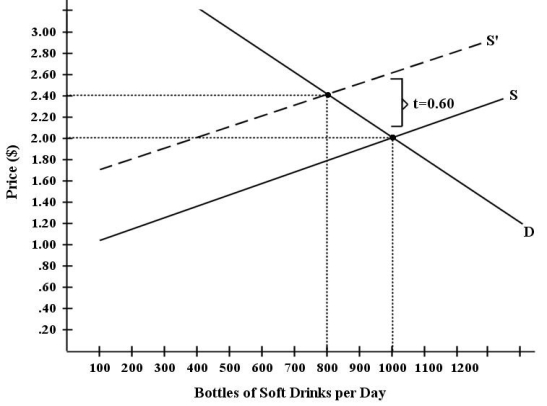

There have been proposals that a tax be imposed on sugar-laden soft drinks in an attempt to reduce their consumption.Assume for simplicity that all bottled soft drinks are the same size.Suppose the initial market equilibrium is P = $2.00 and Q = 1000.  FIGURE 4-4

FIGURE 4-4

-Refer to Figure 4-4.Suppose the government imposes a tax of $0.60 per soft-drink purchased.The after-tax price received by the seller becomes

A) $1.80.

B) $2.00.

C) $2.20.

D) $2.40.

E) $2.60.

Correct Answer:

Verified

Correct Answer:

Verified

Q128: If a product's income elasticity of demand

Q129: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5441/.jpg" alt=" FIGURE 4-2 -Refer

Q130: If per capita income increases by 10%

Q131: A demand curve for which any price-quantity

Q132: If Vicky's income increases by 8% and

Q134: Suppose the market supply curve for some

Q135: We can expect that the income elasticity

Q136: If a producer knew his product to

Q137: Consumers will bear a larger burden of

Q138: If the value of the price elasticity