Multiple Choice

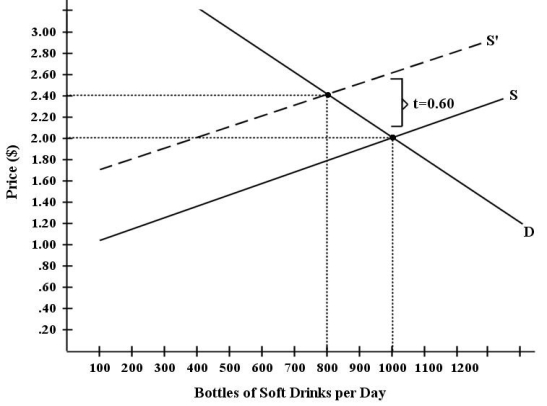

There have been proposals that a tax be imposed on sugar-laden soft drinks in an attempt to reduce their consumption.Assume for simplicity that all bottled soft drinks are the same size.Suppose the initial market equilibrium is P = $2.00 and Q = 1000.  FIGURE 4-4

FIGURE 4-4

-Refer to Figure 4-4.Suppose the government imposes a tax of $0.60 per soft drink purchased.Given the change in total expenditure on soft drinks after imposition of the excise tax,what do we know about the price elasticity of demand (η) for soft drinks?

A) η is equal to 1

B) η is equal to 0

C) η is greater than 1

D) η is less than 1

E) There is not enough information to determine.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: The table below shows the demand schedule

Q23: If household expenditures on electricity remain constant

Q24: If the price elasticity of demand is

Q25: A perfectly horizontal demand curve shows that

Q26: If the total expenditure on perfume increases

Q28: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5441/.jpg" alt=" FIGURE 4-2 -Refer

Q29: The price elasticity of demand measures the

Q30: There have been proposals that a tax

Q31: Which of the following statements about price

Q32: Which of the following illustrates elastic demand?<br>A)A