Multiple Choice

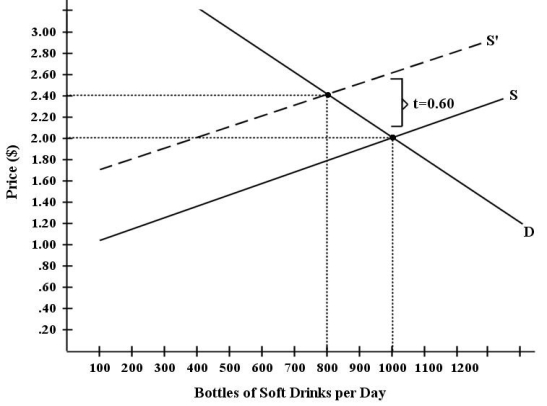

There have been proposals that a tax be imposed on sugar-laden soft drinks in an attempt to reduce their consumption.Assume for simplicity that all bottled soft drinks are the same size.Suppose the initial market equilibrium is P = $2.00 and Q = 1000.  FIGURE 4-4

FIGURE 4-4

-Refer to Figure 4-4.Suppose the government imposes a tax of $0.60 per soft drink purchased.Which of the following statements most accurately describes the economic incidence of this tax?

A) The consumer bears more of the burden because demand is elastic relative to supply.

B) The seller bears more of the burden because supply is inelastic relative to demand.

C) The consumer bears more of the burden because demand is inelastic relative to supply.

D) The seller bears more of the burden because supply is elastic relative to demand.

E) The burden is shared equally between consumer and seller because the slopes of the supply and demand curves are the same.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: If the income elasticity of demand for

Q37: Suppose you are advising the government on

Q38: Suppose a fast-food chain determines that the

Q39: Demand Schedule for Ski Tickets<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5441/.jpg"

Q40: When a product's price has an inverse

Q42: Demand Schedule for Ski Tickets<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5441/.jpg"

Q43: Suppose the price elasticity of demand for

Q44: The "economic incidence" of an excise tax

Q45: Suppose a fast-food chain determines that the

Q46: If total expenditure on a product rises