Multiple Choice

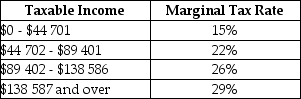

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the portion of earnings taxed at the maximum rate of 29%?

A) $0

B) $1817

C) $8003

D) $23 621

E) $34 800

Correct Answer:

Verified

Correct Answer:

Verified

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5441/.jpg" alt=" FIGURE 18-1 -Refer

Q14: In Canada,public primary and secondary education<br>A)are exclusive

Q15: Consider the allocation of a nation's resources

Q16: One equity-based argument against government subsidies for

Q17: Interest earnings from accumulated savings are subject

Q19: The two main competing goals in the

Q20: The important debate about the appropriate balance

Q21: Which of the following best explains the

Q22: One efficiency-based argument in favour of government

Q23: Suppose a firm buys $1000 worth of