Multiple Choice

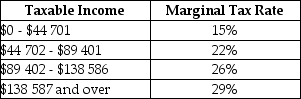

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the rate of 22%?

A) $1629

B) $17 004

C) $9834

D) $26 400

E) $28 020

Correct Answer:

Verified

Correct Answer:

Verified

Q76: The Canada Health Transfer (CHT)and the Canada

Q77: If a tax system contains some important

Q78: In Canada,the corporate income tax is integrated

Q79: Suppose there is only one movie theatre

Q80: Which of the following statements suggests that

Q82: When assessing a tax system,"vertical equity" refers

Q83: The diagram below shows supply and demand

Q84: Since corporate income taxes are levied on

Q85: The five pillars of Canadian social policy

Q86: The direct burden of a tax is