Multiple Choice

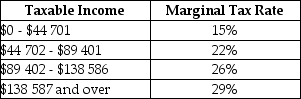

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $138 586,how much total federal tax would be due?

A) $497

B) $5639

C) $24 794

D) $29 327

E) $36 032

Correct Answer:

Verified

Correct Answer:

Verified

Q35: The tax that generates the greatest proportion

Q36: Social and economic policies often involve a

Q37: The Canada Health Transfer (CHT)is scheduled to

Q38: Suppose an income tax is levied in

Q39: One of the guiding principles in Canada's

Q41: A Laffer curve<br>A)relates the marginal tax rate

Q42: In Canada,taxes are levied and collected by<br>A)the

Q43: Suppose there is only one movie theatre

Q44: What is a demogrant?<br>A)A federal transfer to

Q45: In 2015,the federal income-tax rate was graduated