Multiple Choice

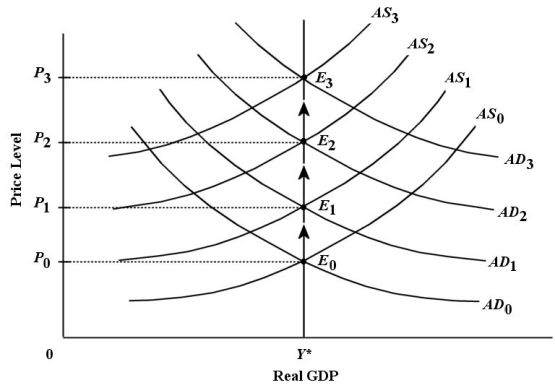

Consider the AD/AS model below with a constant rate of inflation.No exogenous AD or AS shocks are occurring.  FIGURE 29-1

FIGURE 29-1

-Refer to Figure 29-1.Suppose the constant rate of inflation is 3%.In this case,

A) equilibrium GDP and the price level are each increasing at a constant rate of 3% per year.

B) the AS curve is shifting upward by 3% per year and the AD curve remains stationary.

C) the AD curve is shifting upward by 3% per year and the AS curve remains stationary.

D) an annual shift upward of each of the AS and AD curves by 1.5% leads to a constant rate of inflation of 3%.

E) an annual shift upward of the AS curve by 3% is matched by an annual shift upward of the AD curve by 3%.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Assuming that the economy is currently in

Q7: Suppose the Canadian economy is booming due

Q83: If the Bank of Canada validates a

Q85: 29.3 Reducing Inflation<br>The three figures below show

Q86: A constant inflation in the AD/AS macro

Q87: 29.3 Reducing Inflation<br>The three figures below show

Q88: Suppose economists were able to measure frictional

Q89: Consider the AD/AS model below with a

Q91: A central bank might decide to "validate"

Q92: Consider the statement "Inflation is everywhere and