Essay

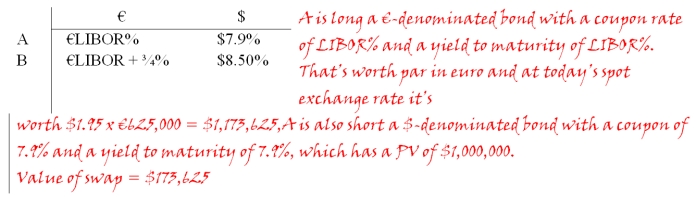

Suppose that the swap that you proposed in question 2 is now 4 years old (i.e.there is exactly one year to go on the swap).If the spot exchange rate prevailing in year 4 is $1.8778 = €1 and the 1-year forward exchange rate prevailing in year 4 is $1.95 = €1,what is the value of the swap to the party paying dollars? If the swap were initiated today the correct rates would be as shown:  Consider the situation of firm A and firm B.The current exchange rate is $1.50/€.Firm A is a U.S.MNC and wants to borrow €40 million for 2 years.Firm B is a French MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown; both firms have AAA credit ratings.

Consider the situation of firm A and firm B.The current exchange rate is $1.50/€.Firm A is a U.S.MNC and wants to borrow €40 million for 2 years.Firm B is a French MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown; both firms have AAA credit ratings.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Consider fixed-for-fixed currency swap. Firm A is

Q28: Company X wants to borrow $10,000,000 floating

Q29: Suppose the quote for a five-year swap

Q31: Suppose the quote for a five-year swap

Q34: In an interest-only currency swap<br>A)the counterparties must

Q36: Devise a direct swap for A and

Q36: When a swap bank serves as a

Q37: Use the following information to calculate the

Q67: A major risk faced by a swap

Q94: XYZ Corporation enters into a 6-year interest