Multiple Choice

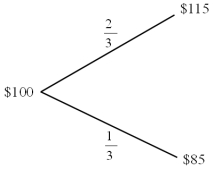

Find the value of a call option written on €100 with a strike price of $1.00 = €1.00.In one period there are two possibilities: the exchange rate will move up by 15% or down by 15% .The U.S.risk-free rate is 5% over the period.The risk-neutral probability of dollar depreciation is 2/3 and the risk-neutral probability of the dollar strengthening is 1/3.

A) $9.5238

B) $0.0952

C) $0

D) $3.1746

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Using your results from parts a and

Q16: If the call finishes out-of-the-money what is

Q20: Today's settlement price on a Chicago Mercantile

Q24: An "option" is<br>A)a contract giving the seller

Q28: Find the input d<sub>1</sub> of the Black-Scholes

Q32: The hedge ratio<br>A)Is the size of the

Q50: A put option on $15,000 with a

Q69: The Black-Scholes option pricing formulae<br>A)are used widely

Q71: Comparing "forward" and "futures" exchange contracts, we

Q93: State the composition of the replicating portfolio;