Multiple Choice

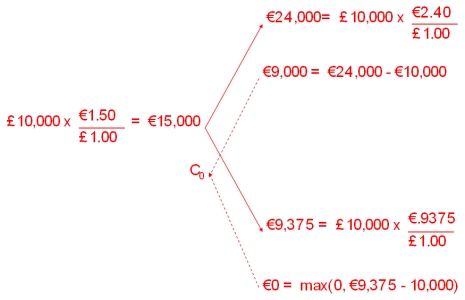

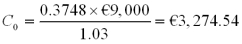

Use the binomial option pricing model to find the value of a call option on £10,000 with a strike price of €12,500. The current exchange rate is €1.50/£1.00 and in the next period the exchange rate can increase to €2.40/£ or decrease to €0.9375/€1.00 .

The current interest rates are i€ = 3% and are i£ = 4%.

Choose the answer closest to yours.

A) €3,275

B) €2,500

C) €3,373

D) €3,243  And thereby the value call is

And thereby the value call is

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Find the cost today of your hedge

Q14: Calculate the current €/£ spot exchange rate.

Q49: Which equation is used to define the

Q50: If the call finishes in-the-money what is

Q51: Three days ago, you entered into a

Q71: Yesterday,you entered into a futures contract to

Q82: For European options, what of the effect

Q86: Find the risk neutral probability of an

Q87: Which of the following is correct?<br>A)Time value

Q96: Use your results from the last three