Multiple Choice

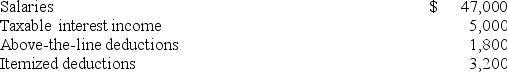

Mr.and Mrs.Liddy,ages 39 and 41,file a joint return and have no dependents for the year.Here is their relevant information.Standard Deduction Table.

Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.

A) AGI $50,200; taxable income $29,400.

B) AGI $52,000; taxable income $31,300.

C) AGI $52,000; taxable income $29,400.

D) AGI $50,200; taxable income $40,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Mr.and Mrs.Warren's AGI last year was $90,300,and

Q35: Julie,an unmarried individual,lives in a home with

Q37: An individual who files his own tax

Q38: Leon died on August 23,2015,and his wife

Q39: The highest individual marginal rate for regular

Q43: Mr.Marshall was employed by IMP Inc.until October,when

Q44: Mr.and Mrs.Jelk file a joint return.They provide

Q49: The earned income credit offsets the burden

Q92: Miss Blixen's regular income tax is $77,390,

Q98: The tax rates for individuals who qualify