Multiple Choice

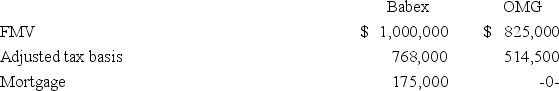

Babex Inc.and OMG Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute Babex's gain recognized on the exchange and its tax basis in the property received from OMG.

Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute Babex's gain recognized on the exchange and its tax basis in the property received from OMG.

A) $175,000 gain recognized; $768,000 basis in OMG property.

B) No gain recognized; $768,000 basis in OMG property.

C) $175,000 gain recognized; $943,000 basis in OMG property.

D) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Gain realized on a property exchange that

Q30: A flood destroyed a business asset owned

Q38: V&P Company exchanged unencumbered investment land for

Q50: Which of the following statements about the

Q54: Gem Company's manufacturing facility was destroyed by

Q58: The wash sale rule can result in

Q71: A taxpayer who receives or pays boot

Q79: When unrelated parties agree to an exchange

Q85: Oxono Company realized a $74,900 gain on

Q93: Tarletto Inc.'s current year income statement includes