Multiple Choice

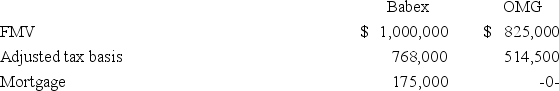

Babex Inc.and OMG Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

A) $175,000 gain recognized; $514,500 basis in Babex property.

B) No gain recognized; $689,500 basis in Babex property.

C) No gain recognized; $514,500 basis in Babex property.

D) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Mr.and Mrs.Eyre own residential rental property that

Q20: Muro Inc. exchanged an old inventory item

Q25: If a taxpayer elected to defer a

Q46: Loonis Inc.and Rhea Company formed LooNR Inc.by

Q66: A fire destroyed furniture and fixtures used

Q84: Vandals destroyed a business asset owned by

Q88: The substituted basis rule results in permanent

Q92: Yelano Inc.exchanged an old forklift used in

Q95: Johnson Inc.and C&K Company entered into an

Q99: A fire destroyed equipment used by BLP