Multiple Choice

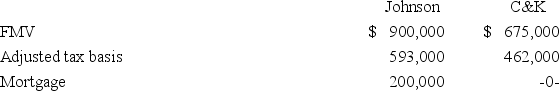

Johnson Inc.and C&K Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

A) $200,000 gain recognized; $662,000 basis in Johnson property.

B) No gain recognized; $462,000 basis in Johnson property.

C) No gain recognized; $487,000 basis in Johnson property.

D) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The tax basis in property received in

Q16: Five years ago, Q&J Inc. transferred land

Q22: Mr. Bentley exchanged investment land subject to

Q27: Signo Inc.'s current year income statement includes

Q43: In a like-kind exchange in which both

Q48: Eight years ago,Prescott Inc.realized a $16,200 gain

Q57: On January 21,2007,Andy purchased 350 shares of

Q63: Mr. Slake sold 1,580 shares of publicly

Q96: Mr. Weller and the Olson Partnership entered

Q99: Mrs.Brinkley transferred business property (FMV $340,200; adjusted