Multiple Choice

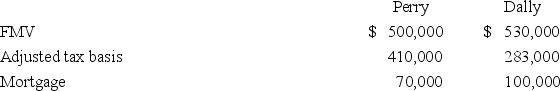

Perry Inc.and Dally Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

A) No gain recognized; $410,000 basis in the Dally property.

B) No gain recognized; $440,000 basis in the Dally property.

C) $100,000 gain recognized; $410,000 basis in the Dally property.

D) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: All types of business and investment real

Q7: Vincent Company transferred business realty (FMV $2.3

Q9: Loonis Inc. and Rhea Company formed LooNR

Q23: Mrs. Brinkley transferred business property (FMV $340,200;

Q26: A taxpayer who realizes a loss on

Q29: Denali,Inc.exchanged equipment with a $230,000 adjusted basis

Q33: Acme Inc.and Beamer Company exchanged like-kind production

Q35: On July 2,2017,a tornado destroyed an asset

Q39: Luce Company exchanged the copyright on a

Q73: IPM Inc.and Zeta Company formed IPeta Inc.by