Multiple Choice

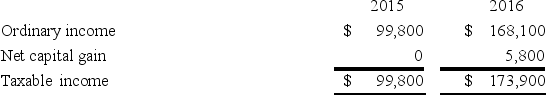

Fantino Inc.was incorporated in 2015 and adopted a calendar year for tax purposes.Here is a schedule of Fantino's taxable income for 2015 and 2016.Use Corporate tax rate schedule.

In 2017,Fantino generated $297,300 ordinary income and recognized a $14,000 net capital loss.Which of the following statements is true?

In 2017,Fantino generated $297,300 ordinary income and recognized a $14,000 net capital loss.Which of the following statements is true?

A) Fantino can deduct its $14,000 net capital loss only on a carryforward basis.

B) Fantino can carry the net capital loss back to 2015 and receive a $4,760 refund of 2015 tax.

C) Fantino can carry the net capital loss back to 2016 and receive a $5,460 refund of 2016 tax.

D) Fantino can carry the net capital loss back to 2016 and receive a $2,262 refund of 2016 tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Mrs.Tinker paid $78,400 to purchase 15,000 shares

Q9: R&T Inc.made the following sales of capital

Q29: Dolzer Inc.sold a business asset with a

Q35: Which of the following is a capital

Q56: WQP Company generated $1,814,700 ordinary income from

Q72: A fire destroyed business equipment that was

Q97: In its current tax year, PRS Corporation

Q98: Four years ago, Mrs. Beights purchased marketable

Q112: Ficia Inc.owned investment land subject to a

Q114: Mr.Quick sold marketable securities with a $112,900