Multiple Choice

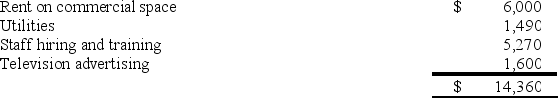

Puloso Company,a calendar year taxpayer,incurred the following start-up expenditures before the opening of its new health and fitness center.

The Puloso Center opened its doors for business on March 21,2017.How much of the start-up expenditures can Puloso deduct in 2017?

The Puloso Center opened its doors for business on March 21,2017.How much of the start-up expenditures can Puloso deduct in 2017?

A) -0-

B) $5,000

C) $5,520

D) $14,360

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Repair costs incurred to keep a tangible

Q24: BriarHill Inc.purchased four items of tangible personalty

Q25: Which of the following statements about the

Q27: Hextone Inc.,which has a 35% tax rate,purchased

Q33: W&F Company,a calendar year taxpayer,purchased a total

Q35: Mann Inc. paid $7,250 to a leasing

Q50: Tregor Inc., which manufactures plastic components, rents

Q74: Hoopin Oil Inc.was allowed to deduct $5.3

Q89: Poole Company made a $100,000 cash expenditure

Q113: Cobly Company, a calendar year taxpayer, made