Multiple Choice

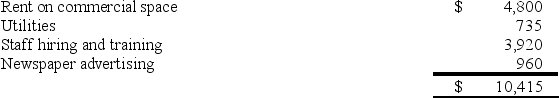

Vane Company,a calendar year taxpayer,incurred the following expenditures in the preoperating phase of a new health and fitness center.

Which of the following statements is true?

Which of the following statements is true?

A) If Vane already operates seven other health and fitness centers,it can deduct the $10,415 preoperating expenditures of the eighth center as expansion costs.

B) If Vane is a cash basis taxpayer,it can deduct $10,415 in the year of payment.

C) If the new center represents a new business for Vane,it must capitalize the $10,415 preoperating expenditures.

D) None of the above is true

Correct Answer:

Verified

Correct Answer:

Verified

Q33: W&F Company,a calendar year taxpayer,purchased a total

Q35: Mann Inc. paid $7,250 to a leasing

Q37: Essco Inc., a calendar year taxpayer, made

Q38: NLT Inc.purchased only one item of tangible

Q39: Pyle Inc.,a calendar year taxpayer,generated over $10

Q50: Tregor Inc., which manufactures plastic components, rents

Q51: In an inflationary economy, the use of

Q62: On November 7, a calendar year business

Q89: Poole Company made a $100,000 cash expenditure

Q113: Cobly Company, a calendar year taxpayer, made