Multiple Choice

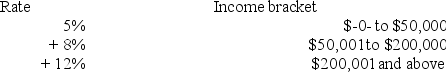

Jurisdiction M imposes an individual income tax based on the following schedule.

Which of the following statements is true?

Which of the following statements is true?

A) The schedule provides no information as to whether Jurisdiction M's tax is horizontally equitable.

B) Jurisdiction M's tax is vertically equitable.

C) Jurisdiction M's tax is vertically equitable only for individuals with $50,000 or less taxable income.

D) Both "The schedule provides no information as to whether Jurisdiction M's tax is horizontally equitable" and "Jurisdiction M's tax is vertically equitable" are true.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Jurisdiction M imposes an individual income tax

Q5: A dynamic forecast of the revenue effect

Q12: Which of the following taxes is most

Q18: If a tax has a proportionate rate

Q22: Which of the following statements concerning tax

Q25: According to the classical concept of efficiency,

Q42: Which of the following statements concerning income

Q54: Which of the following statements about a

Q55: The city of Hartwell spends about $3

Q62: Which of the following statements about vertical