Multiple Choice

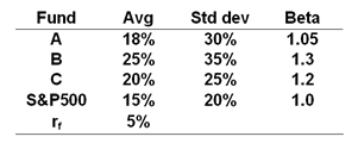

The risk-free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.  What is the M2 measure for Portfolio B?

What is the M2 measure for Portfolio B?

A) 0.43%

B) 1.25%

C) 1.77%

D) 1.43%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Probably the biggest problem with evaluating portfolio

Q16: A passive benchmark portfolio is _.<br>I.a portfolio

Q20: The correct measure of timing ability is

Q37: The market timing form of active portfolio

Q42: The average returns, standard deviations and betas

Q43: A portfolio generates an annual return of

Q43: Portfolio performance is often decomposed into various

Q47: The table presents the actual return of

Q49: The _ calculates the reward to risk

Q50: The M<sup>2</sup> measure of portfolio performance was