Multiple Choice

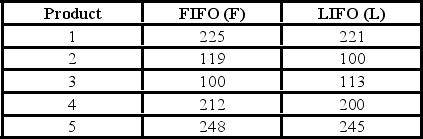

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method.  If you use the 5% level of significance,what is the critical t-value?

If you use the 5% level of significance,what is the critical t-value?

A) +2.132

B) ±2.132

C) +2.262

D) ±2.228

Correct Answer:

Verified

Correct Answer:

Verified

Q12: The results of a mathematics placement exam

Q13: A statistics professor wants to compare grades

Q14: An investigation of the effectiveness of a

Q15: A company is researching the effectiveness of

Q16: Accounting procedures allow a business to evaluate

Q18: Accounting procedures allow a business to evaluate

Q19: A national manufacturer of ball bearings is

Q20: For a hypothesis test comparing two population

Q21: The results of a mathematics placement exam

Q22: When testing the hypothesized equality of two