Multiple Choice

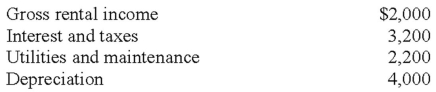

Lori and Donald own a condominium in Colorado Springs,Colorado,that they rent out part of the time and use during the summer.The rental property is classified as personal/rental property and their personal use is determined to be 75% (based on the IRS method) .They had the following income and expenses for the year (before any allocation) :  How much net loss should Lori and Donald report for their condominium on their tax return this year?

How much net loss should Lori and Donald report for their condominium on their tax return this year?

A) $0.

B) $3,350 loss.

C) $7,400 loss.

D) $9,000 loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: What are the rules concerning the deductibility

Q27: Jacqueline owns a condominium on an island

Q28: Rental income may be reported on a

Q29: Which of the following statements is incorrect

Q59: Jackson owns a condominium in Las Vegas,

Q64: Which of the following statements is true

Q67: A taxpayer may use a Schedule C

Q77: Royalties resulting from a non-trade or non-business

Q92: If a family member of a taxpayer

Q95: Meredith has a vacation rental house in