Essay

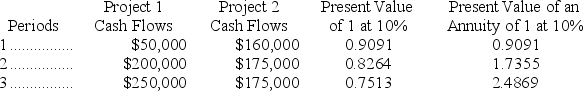

Braybar Company is deciding between two projects.Each project requires an initial investment of $350,000.The projected net cash flows for the two projects are listed below.The revenue is to be received at the end of each year.Braybar requires a 10% return on its investments.The present value of an annuity of 1 and present value of an annuity factors for 10% are presented below.Use net present value to determine which project should be pursued and explain why.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: A company is considering a proposal to

Q8: Sherman Company can sell all of its

Q30: The accounting rate of return uses cash

Q50: When making capital budgeting decisions, companies usually

Q54: The _ is computed by discounting the

Q93: You have evaluated three projects using the

Q129: If two projects have the same risks,

Q129: The accounting rate of return is calculated

Q147: A disadvantage of using the payback period

Q174: A(n) _ is the potential benefit lost