Multiple Choice

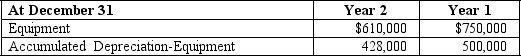

Sebring Company reports depreciation expense of $40,000 for Year 2.Also,equipment costing $140,000 was sold for a $5,000 gain in Year 2.The following selected information is available for Sebring Company from its comparative balance sheet.Compute the cash received from the sale of the equipment.

A) $23,000.

B) $33,000.

C) $28,000.

D) $40,000.

E) $68,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The statement of cash flows is divided

Q79: A company had average total assets of

Q96: A company purchased equipment for $150,000 by

Q116: When preparing a statement of cash flows

Q119: Sebring Company reports depreciation expense of $40,000

Q120: The following selected account balances are taken

Q122: Use the following information to calculate cash

Q123: If a company borrows money from a

Q160: Investments that are readily convertible to a

Q174: The reporting of investing and financing activities