Essay

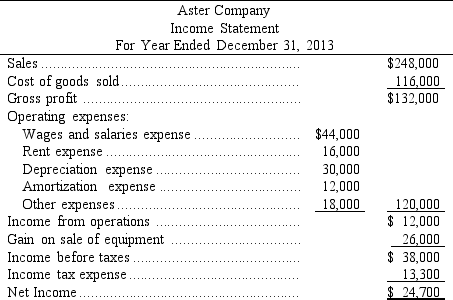

Aster Company's 2013 income statement and changes in selected balance sheet accounts are given below.Calculate the company's net cash provided or used by operating activities using the direct method.

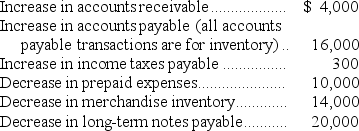

The company also experienced the following during 2013:

The company also experienced the following during 2013:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: When using the indirect method to calculate

Q9: The statement of cash flows reports:<br>A)Cash flows

Q27: Explain the purpose and format of the

Q28: The first line item in the operating

Q31: The statement of cash flows reports and

Q31: The usual first step in preparing the

Q43: The indirect method separately lists each major

Q77: The appropriate section in the statement of

Q114: Hancock reported assets of $13,362 million at

Q132: The use of a spreadsheet for analysis