Essay

A company issued 10%,10-year bonds with a par value of $1,000,000 on January 1,at a selling price of $885,295,to yield the buyers a 12% return.The company uses the effective interest amortization method.Interest is paid semiannually each June 30 and December 31.

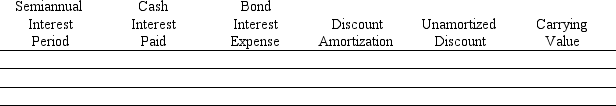

(1)Prepare an amortization table for the first two payment periods using the format shown below:

(2)Prepare the journal entry to record the first semiannual interest payment.

(2)Prepare the journal entry to record the first semiannual interest payment.

Correct Answer:

Verified

(1)

6/30/:

6/30/:

Cash payment: $1,000,000 * ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Cash payment: $1,000,000 * ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: A company has bonds outstanding with a

Q65: A company calls $150,000 par value of

Q69: Match each of the following terms with

Q70: Match each of the following terms with

Q75: The equal total payments pattern for installment

Q88: On January 1, a company issues bonds

Q124: Promissory notes that require the issuer to

Q163: On January 1, a company issued 10-year,

Q214: An _ is a series of equal

Q216: Payments on an installment note normally include