Essay

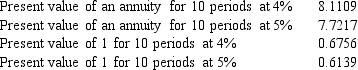

On January 1,a company issues bonds with a par value of $300,000.The bonds mature in 5 years,and pay 8% annual interest,payable each June 30 and December 31.On the issue date,the market rate of interest for the bonds is 10%.Compute the price of the bonds on their issue date.The following information is taken from present value tables:

Correct Answer:

Verified

Correct Answer:

Verified

Q18: A company has bonds outstanding with a

Q54: An advantage of bond financing is that

Q61: Mortgage contracts grant the lender the right

Q77: Bonds that have an option exercisable by

Q83: A company issued 9.2%, 10-year bonds with

Q94: The party that has the right to

Q104: A company issued 10-year,9% bonds with a

Q112: On January 1 of Year 1,Drum Line

Q161: Collateral from unsecured loans may be sold

Q188: Two common ways of retiring bonds before