Essay

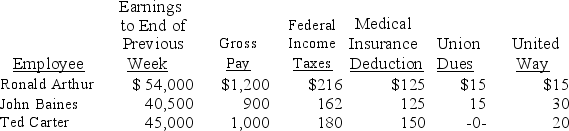

The payroll records of a company provided the following data for the weekly pay period ended December 7:

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Amounts received in advance from customers for

Q25: FUTA taxes are:<br>A)Social Security taxes.<br>B)Medicare taxes.<br>C)Employee income

Q129: A _ is a written promise to

Q131: A short-term note payable:<br>A) Is a written

Q131: All of the following statements related to

Q148: FICA taxes include:<br>A)Social Security taxes.<br>B)Charitable giving.<br>C)Employee income

Q151: Each employee records the number of withholding

Q152: Classify each of the following items as

Q154: A payroll register usually shows the pay

Q160: A liability does not exist if there