Essay

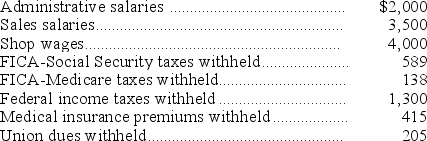

A company's payroll information for the month of May follows:

On May 31 the company issued Check No.335 payable to the Payroll Bank Account to pay for the May payroll.It issued payroll checks to the employees after depositing the check.

On May 31 the company issued Check No.335 payable to the Payroll Bank Account to pay for the May payroll.It issued payroll checks to the employees after depositing the check.

(1)Prepare the journal entry to record (accrue)the employer's payroll for May.

(2)Prepare the journal entry to record payment of the May payroll.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.The wages and salaries subject to these taxes were $6,000.

(3)Prepare the journal entry to record the employer's payroll taxes.

Correct Answer:

Verified

*$6,000 *...

*$6,000 *...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: A company borrowed $60,000 by signing a

Q40: Unearned revenues are amounts received _ for

Q44: On December 1, Gates Company borrowed $45,000

Q57: The Form W-2 must be given to

Q97: A payroll register is a cumulative record

Q98: A merit rating:<br>A)Is assigned by the state.<br>B)Reflects

Q101: Short-term notes payable:<br>A)Can replace an account payable.<br>B)Can

Q104: Arena Company's salaried employees earn two weeks

Q112: Times interest earned is calculated by:<br>A) Multiplying

Q178: Employer payroll taxes are an added employee