Essay

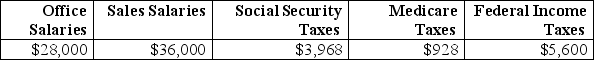

Frado Company provides you with following information related to payroll transactions for the month of May.Prepare journal entries to record the transactions for May.

a.Recorded the March payroll using the payroll register information given above.

a.Recorded the March payroll using the payroll register information given above.

b.Recorded the employer's payroll taxes resulting from the March payroll.The company had a merit rating that reduces its state unemployment tax rate to 3.5% of the first $7,000 paid each employee.Only $42,000 of the current months salaries are subject to unemployment taxes.The federal rate is .8%.

c.Issued a check to Swift Bank in payment of the May FICA and employee taxes.

d.Issued a check to the state for the payment of the SUTA taxes for the month of May.

e.Issued a check to Swift Bank in payment of the employer's quarterly FUTA taxes for the first quarter in the amount of $1,360.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Contingent liabilities must be recorded if:<br>A)The future

Q23: Federal depository banks are authorized to accept

Q33: Identify and explain the types of employer

Q55: A company's income before interest expense and

Q59: _ are obligations due within one year

Q62: A bank that is authorized to accept

Q76: The annual Federal Unemployment Tax Return is:<br>A)

Q124: A _ is a potential obligation that

Q142: The matching principle requires that interest expense

Q155: On November 1, Bob's Skateboards signed a