Essay

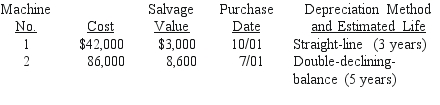

A company's property records revealed the following information about its plant assets:

Calculate the depreciation expense for each machine for the year ended December 31 for Year

Calculate the depreciation expense for each machine for the year ended December 31 for Year

1,and for the year ended December 31 for Year 2.

Machine 1:

Year 1______________________ Year 2 _______________________

Machine 2:

Year 1 ______________________ Year 2 _______________________

Correct Answer:

Verified

Machine 1:

Year 1: [($42,000 -...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Year 1: [($42,000 -...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: A company purchased land with a building

Q84: If a machine is damaged during unpacking,

Q94: Big River Rafting pays $310,000 plus $15,000

Q95: Gain or loss on the disposal of

Q96: Prepare journal entries to record the following

Q98: On April 1,2013,a company discarded a computer

Q103: A company purchased equipment on July 3

Q116: An asset's book value is $36,000 on

Q127: _is an estimate of an asset's

Q245: Natural resources are assets that include standing