Multiple Choice

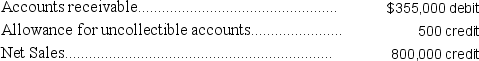

A company uses the percent of sales method to determine its bad debts expense.At the end of the current year,the company's unadjusted trial balance reported the following selected amounts: All sales are made on credit.Based on past experience,the company estimates 0.6% of credit sales to be uncollectible.What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

All sales are made on credit.Based on past experience,the company estimates 0.6% of credit sales to be uncollectible.What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

A) $1,275

B) $1,775

C) $4,500

D) $4,800

E) $5,500

Correct Answer:

Verified

Correct Answer:

Verified

Q35: The use of an allowance for bad

Q42: Hankco accepts all major bank credit cards,

Q71: Cairo Co. uses the allowance method of

Q97: Griggs Company uses the direct write-off method

Q101: The direct write-off method of accounting for

Q114: All of the following are true regarding

Q118: Define a note receivable and explain how

Q160: How are the direct write-off method and

Q196: Installment accounts receivable is another name for

Q198: The quality of receivables refers to the