Essay

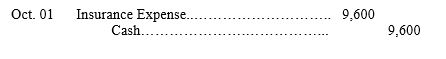

On October 1 of the current year,Morton Company paid $9,600 cash for a one-year insurance policy that took effect on that day.On the date of the payment,Morton recorded the following entry:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q42: It is acceptable to record cash received

Q44: The balance in Tee Tax Services' office

Q66: All of the following are true regarding

Q86: Adjusting entries:<br>A) Affect only income statement accounts.<br>B)

Q138: The accrual basis of accounting:<br>A) Is generally

Q146: Ben had total assets of $149,501,000, net

Q147: The revenue recognition principle is the basis

Q171: In preparing statements from the adjusted trial

Q211: _ revenues are liabilities requiring delivery of

Q220: Accrued revenues at the end of one