Essay

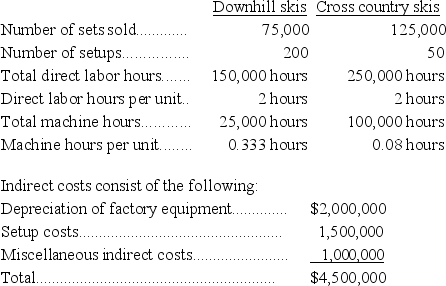

Outdoor Sports,Inc.,produces two types of skis,downhill skis and cross country skis.Product and production information about the two items is shown below:

Required:

Required:

1.If Outdoor Sports uses the traditional two-stage method of allocating overhead costs based on direct labor hours,what is the amount of indirect costs per set of skis for each of the two types of skis?

2.If Outdoor Sports uses activity based costing,what is the total amount of indirect costs per set of skis for each of the two types of skis?

Assume that depreciation is allocated based on machine hours,setup costs based on the number of setups,and miscellaneous costs based on the number of direct labor hours.

Correct Answer:

Verified

1.Traditional costin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Precision Brackets,Co.is considering switching from traditional allocation

Q7: Drewniak Corporation has provided the following data

Q8: Wecker Corporation uses the following activity rates

Q9: Unit costs can be significantly different when

Q11: The following is taken from Ames Company's

Q15: Ekmark Corporation uses the following activity rates

Q34: A factor that causes the cost of

Q56: Why would a firm use activity-based costing

Q71: Billabong Resources provides the following data to

Q147: A basis for allocating the cost of