Essay

Cosgrove Company manufactures two products,Product K-7 and Product L-15.Product L-15 is of fairly recent origin,having been developed as an attempt to enter a market closely related to that of Product K-7.Product L-15 is the more complex of the two products,requiring 2.0 hours of direct labor time per unit to manufacture compared to 1.0 hour of direct labor time for Product K-7.Product L-15 is produced on an automated production line.

Overhead currently is applied to the products on the basis of direct labor-hours.The company estimated it would incur $510,000 in manufacturing overhead costs and produce 10,000 units of Product L-15 and 40,000 units of Product K- 7 during the current year.

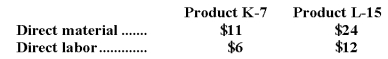

Unit costs for materials and labor are:

Required:

a.Compute the predetermined overhead rate under the current method,and determine the unit product cost of each product for the current year.

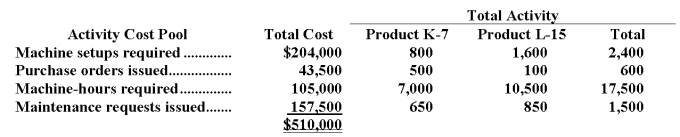

b.The company is considering the use of activity-based costing as an alternative to its traditional costing method for manufacturing overhead.Data relating to the company's activity cost pools for the current year are given below:

Using the data above,determine the unit product cost of each product for the current year.

c.What items of overhead cost make Product L-15 so costly to produce according to the activity-based costing system?

What influence might the activity-based costing data have on management's opinions regarding the profitability of Product L-15?

Correct Answer:

Verified

a.The company expects to work 60,000 dir...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Daba Company manufactures two products,Product F and

Q17: Bossie Corporation uses an activity-based costing system

Q18: Larabee Company produces two types of product,flat

Q20: Spendlove Corporation has provided the following data

Q23: In activity-based costing,there are a number of

Q24: Reach Consulting Corporation has its headquarters in

Q25: The following is taken from Ames Company's

Q46: A _ is a factor that causes

Q65: A system of assigning costs to departments

Q159: Activity-based costing assigns costs first to activity