Multiple Choice

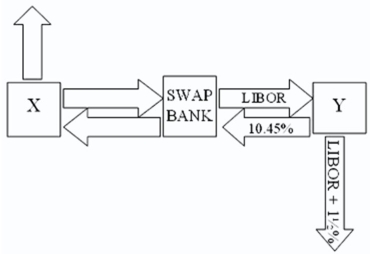

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below.

A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05 percent -10.45 percent against LIBOR flat.

Assume company Y has agreed,but company X will only agree to the swap if the bank offers better terms.

What are the absolute best terms the bank can offer X,given that it already booked Y?

A) 10.45% ?10.45% against LIBOR flat.

B) 10.45%?10.05% against LIBOR flat.

C) 10.50%?10.50% against LIBOR flat.

D) none of the options

Correct Answer:

Verified

Correct Answer:

Verified

Q44: A major that can be eliminated through

Q45: Consider a fixed for fixed currency swap.The

Q46: Consider the situation of firm A

Q47: A is a U.S.-based MNC with

Q48: The size of the swap market (as

Q50: Examples of "single-currency interest rate swap" and

Q51: Suppose ABC Investment Banker Ltd.,is quoting swap

Q52: Suppose that you are a swap

Q53: Consider fixed-for-fixed currency swap.Firm A is a

Q54: Company X wants to borrow $10,000,000