Multiple Choice

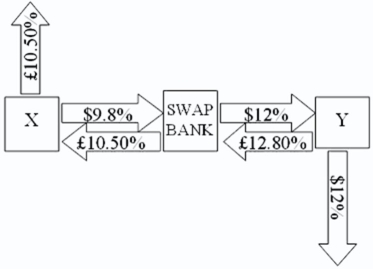

Company X wants to borrow $10,000,000 for 5 years; company Y wants to borrow £5,000,000 for 5 years.The exchange rate is $2 = £1 and is not expected to change over the next 5 years.Their external borrowing opportunities are shown here: A swap bank proposes the following interest only swap:

X will pay the swap bank annual payments on $10,000,000 with the coupon rate of 9.80 percent; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5 percent.Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80 percent and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12 percent.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

A) The swap bank will earn 10 basis points per year; the only risk is default risk.

B) The swap bank will earn 10 basis points per year but has exchange rate risk: dollar-denominated income and pound-denominated costs and default risk.

C) The swap bank will earn 10 basis points per year but has exchange rate risk: pound-denominated income and dollar-denominated costs and default risk.

D) The swap bank will earn 20 basis points per year in dollars but has exchange rate risk: pound-denominated income and dollar-denominated costs and default risk.

Correct Answer:

Verified

Correct Answer:

Verified

Q73: A major risk faced by a swap

Q74: Come up with a swap (principal

Q75: Swaps are said to offer market completeness.<br>A)This

Q76: Consider the situation of firm A

Q77: A swap bank has identified two companies

Q79: Compute the payments due in the

Q80: Consider the situation of firm A

Q81: XYZ Corporation enters into a 6-year interest

Q82: Which combination of the following represent the

Q83: Suppose that you are a swap