Essay

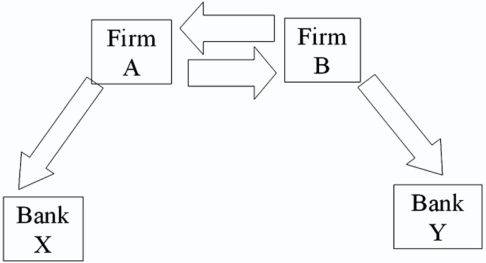

Consider the situation of firm A and firm B.The current exchange rate is $2.00/£ Firm A is a U.S.MNC and wants to borrow £30 million for 2 years.Firm B is a British MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown,both firms have AAA credit ratings.

The IRP 1-year and 2-year forward exchange rates are ($ ∣ £)= = ($ ∣ £)= = USD pounds

Devise a direct swap for A and B that has no swap bank.Show their external borrowing.Answer the problem in the template provided

Correct Answer:

Verified

Correct Answer:

Verified

Q59: Consider the situation of firm A

Q60: With regard to a swap bank acting

Q61: Consider the situation of firm A

Q62: Suppose the quote for a five-year swap

Q63: Amortizing currency swaps<br>A)decrease the debt service exchanges

Q65: Consider the situation of firm A

Q66: Pricing a currency swap after inception involves<br>A)finding

Q67: Consider the situation of firm A

Q68: Consider the situation of firm A

Q69: Consider the situation of firm A