Multiple Choice

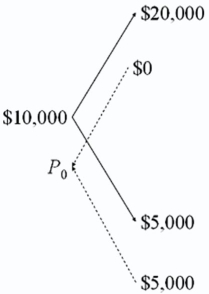

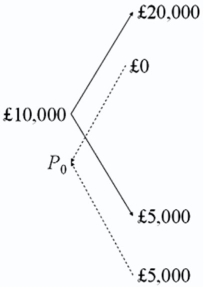

Draw the tree for a put option on $20,000 with a strike price of £10,000.The current exchange rate is £1.00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half.The current interest rates are i$ = 3% and are i£ = 2%.

A)

B)

C) both of the options

D) none of the options

Correct Answer:

Verified

Correct Answer:

Verified

Q36: A currency futures option amounts to a

Q37: Consider an option to buy £10,000

Q38: Today's settlement price on a Chicago Mercantile

Q39: Consider an option to buy €12,500

Q40: With regard to trading location,<br>A)forward contracts are

Q42: The volume of OTC currency options trading

Q43: Suppose that you have written a call

Q44: An investor believes that the price of

Q45: With regard to contractual size,<br>A)forward contracts are

Q46: Find the dollar value today of a