Multiple Choice

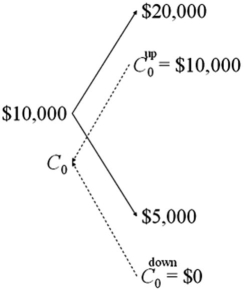

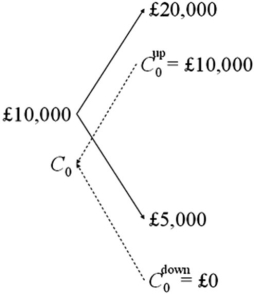

Draw the tree for a call option on $20,000 with a strike price of £10,000.The current exchange rate is £1.00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half.The current interest rates are i$ = 3% and are i£ = 2%.

A)

B)

C) both of the options

D) none of the options

Correct Answer:

Verified

Correct Answer:

Verified

Q15: For European currency options written on euro

Q16: Most exchange traded currency options<br>A)mature every month,with

Q17: A binomial call option premium is calculated

Q18: Consider an option to buy £10,000

Q19: Consider an option to buy €12,500

Q21: What paradigm is used to define the

Q22: Consider an option to buy €12,500

Q23: In which market does a clearinghouse serve

Q24: An "option" is<br>A)a contract giving the seller

Q25: American call and put premiums<br>A)should be at